Whether you are planning to establish an SMSF (Self-Managed Super Fund) or already have one, there are some “Golden Rules” to follow for its effective self-management.

RULE #1

Unless you are a fully qualified SMSF Specialist Adviser yourself, you would be well-advised to seek the ongoing assistance of one.

NOTE: You are personally liable for all the fund’s decisions — even if you get help from a professional or if another member made the decision.

As the Controller of your SMSF, you take on the role of Trustee and therefore must abide by the rules that apply to anyone holding that position. The ATO even states that “You are the person in control and if you make a mistake, there can be serious penalties”. This extends to making the investment decisions for the fund, for which you’re held responsible for complying with the super and tax laws.

A special point of note here – The Trustee of an SMSF can either be a corporate entity or an individual/s. The advantages and disadvantages of either should be discussed with your Specialist Adviser.

Remember always – an SMSF must be run for the sole purpose of providing retirement benefits for the members or their dependants. The ATO, in its ongoing compliance assessment of your Fund, will apply what’s known as the “Sole Purpose Test”. Additionally, all decisions you make as trustee of your SMSF must be in the best financial interests of the members.

RULE #2

Regularly review your Fund’s Trust Deed.

Constant legislative changes are made to the rules governing superannuation, and particularly SMSFs. For instance, you may not be aware that an SMSF can now have up to six members. Does your Trust Deed allow for this?

Interesting fact: A properly constructed Family SMSF can have a child of any age as a Fund Member, from the moment they draw their first breath! This factor presents a wealth of opportunities for the Fund’s Members, but to reiterate, the Trust Deed must allow for it.

RULE #3

Upskill your own knowledge.

If you accept the premise of RULE #1, you should still take the time and effort to educate yourself on the basics, as a bare minimum. This includes activities and issues such as:

- researching investment options;

- setting and following an investment strategy;

- accounting, keeping records and arranging an audit each year by an approved SMSF auditor.

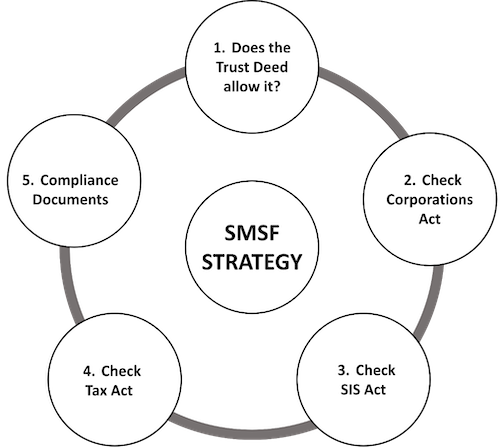

As a guide, your SMSF strategy success will be dependent upon meeting compliance across the following key areas:

Specifically, and most importantly, familiarise yourself with the “Does the Trust Deed allow it?” step.

An often-productive approach to this is to first write down YOUR objectives as to what you want the Fund to be able to do for you and your family. You can get the ball rolling with these initial suggestions:

- Provide a secure income in retirement to substitute or supplement the OAP (Old Age Pension) that is, provide an income to meet your retirement expenditure needs;

- Be invested in the best interests of Fund Members;

- Take advantage of tax benefits and concessions available to SMSF Funds and their Members;

- Having a broad choice of investment options, e.g., investment property (commercial and/or residential), precious metals such as gold, shares, government bonds, antiques, art;

- Have the assurance that your Estate will pass in a timely manner to your beneficiaries in accord with your wishes.

Once you have established what you want from your Fund, it is suggested that you consult your SMSF Specialist Adviser on all the “Can and Can’t Dos” of your Trust Deed and what, if anything, needs to be done to have your Fund providing the benefits you want it to.

FINAL WORD

Your SMSF Fund should never be treated as a “set and forget” entity. Changes in markets and investment classes, legislative changes, and indeed, changes in your own personal circumstances or those of your family and/or other Fund Members, require you to be diligent in regularly reviewing your Fund and its Trust Deed. Doing so will help to ensure that you get the very best benefits from your Fund.

Here at Endorphin Wealth, we are not licensed or owned by the big banks and financial institutions, so the advice and wealth management we provide is always in our client’s best interests. We have the advantage of being able to access a range of products from different providers that can be tailored to our client’s goals and needs. We have offices located in Sydney and Melbourne, where you will be able to find a financial advisor that is suitable for you.

For an obligation free conversation about your financial future, please contact us on 03 9190 8964 or at advice@endorphinwealth.com.au