Investing for the future is

fundamental to reaching the

goals you’re setting

out to achieve.

Whether it’s paying off your home loan sooner, saving for your children’s education or dreams of a sunny vacation, it takes a plan to turn them into a reality. Investing can be much more than just a regular deposit into a bank

account – by taking charge of your financial situation, you can magnify your savings and move towards your goals sooner!

Below are examples of different types of investing that we regularly use.

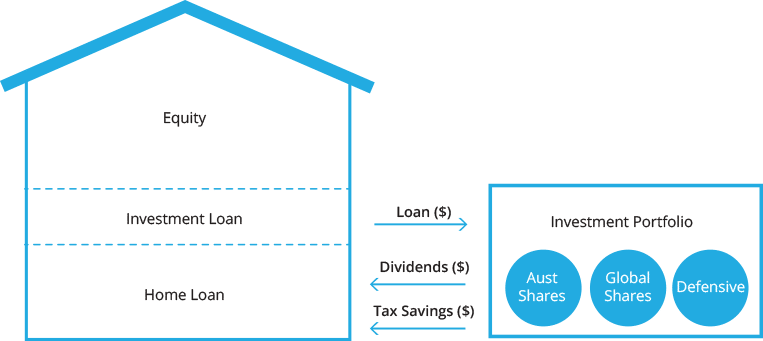

Debt recycling

A debt recycling strategy can enable you to grow a tax effective investment portfolio and can assist in paying off your home loan faster. An interest only loan against the equity in your home is used to invest in a diverse portfolio

of assets. The income generated from the portfolio (dividends and distributions) are directed to the home loan along with all surplus funds

Debt recycling strategy.

Book a consultation.

We're committed to providing customised service and advice to our clients. Prior to scheduling a consultation, we kindly request that you take into account our expertise in catering to high-income individuals, pre-retirees, established business owners, and individuals with investable assets over $500k.

The best strategy for your situation.

"The right advice

every time"

The strategy can assist you to:

- Reach your financial goals sooner (eg clear your home loan)

- Increase net wealth due to accelerated growth assets

- Replace ‘non tax deductible’ debt with ‘tax deductible debt’

- Provide diversity to your overall investments

- Free up valuable cash flow for future years

There are some considerations you will need to take into account before deciding which strategy is best for you:

As the strategy involves gearing, capital gains and losses made on your investment are larger compared to traditional non-geared investment strategies.

This suits investors with a minimum seven-year time frame or those who are willing to accept higher levels of investment value volatility in return for higher potential investment performance.

The scenario is flexible and can be adjusted if your family’s circumstances were to change.

Gearing.

For decades, many Australians have accelerated their wealth accumulation by borrowing money to invest (also known as ‘gearing’). It can also be used with a regular instalment strategy to build a nest egg over time. This strategy does however have a higher level of risk due to the additional exposure to growth assets.

Getting started with financial advice.

"We take pride in

the advice we give"

Make smart decisions about your money.

Make smart decisions about your money.

Retirement has changed, and we need to look at things differently.

Make smart decisions about your money.

Get the right financial advice and a solid wealth management plan.

Get the right financial advice and a solid wealth management plan.