Emerging Markets Beyond 2016

Globalisation has brought many advantages to our modern way of life and we seem to have the whole world at our fingertips. In the same way we have seamless access to fashion from New York or books from London, we are also able to research and invest in companies from the Emerging Markets in the farthest reaches of the globe.

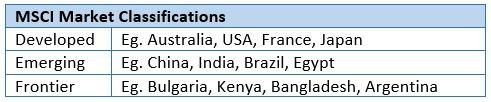

The global research provider MSCI, has classified global economies into three markets: Developed, Emerging and Frontier. The classifications are based on:

+ The sustainability of the country’s economic development,

+ The number of companies within the country that meet certain size and liquidity requirements, and

+ How accessible the country’s markets are including openness to foreign ownership and how easily capital can flow in and out of the country.

You’ll be quite familiar with Developed Economies, however there are opportunities presenting themselves in Emerging Markets that are projected to contribute more than 65% of global growth between now and 2030[1].

Did you know:

+ Eight out of ten of the world’s largest cities are in emerging economies[1]

+ In 2010, annual consumption in Emerging Markets was less than a third of the world’s total consumption. By 2025, it is expected to grow to nearly half the global total[2]

+ By 2020, a further one billion unique mobile subscribers will be added globally with the vast majority coming from emerging economies[3]

+ The growth population and social classes in Emerging Markets leads to billions of dollars being spent each year by governments on infrastructure projects

All of these figures highlight the growth potential in these countries, which in turn leads to opportunities for the companies that can provide them with products and services.

Opportunities

Investors will seek out these companies for the prospect of higher returns due to the increased growth rate within the countries. They will need to have an appetite for some increased risk however, due to less stable governance with domestic infrastructure issues within the countries leading to increased volatility.

We regularly provide financial advice to clients wishing to diversify their portfolio by gaining exposure to global Emerging Markets. We are currently seeing very attractive valuations of companies within these markets such as:

+ Yum! Brands – 6,000 KFC, Pizza Hut and Taco Bell outlets in China

+ Sun Hung Kai Properties – A major property developer in Hong Kong

+ Bharti Airtel and China Mobile – Poised to benefit from increased mobile phone subscribers

We pride ourselves on being experts in researching opportunities and recommending quality companies that fit in with our client’s investment objectives and retirement plans.

For an obligation free conversation about your financial future, please contact us on 03 9603 0072 or at advice@endorphinwealth.com.au

Phillip Richards

Director and Wealth Advisor

Endorphin Wealth Management

Phillip Richards is a qualified Financial Advisor with more than nine years experience in the industry. His expertise in investment, superannuation, SMSF, retirement planning and insurance will help you assess your options to build your wealth. Contact Phillip today to discuss how you can build your own wealth and plan to reach your goals.

This information is general in nature and does not take your personal situation into account. If you are interested in taking control of your wealth, contact Endorphin Wealth Management.

[1] Euromonitor International, September 2015 – http://www.euromonitor.com/

[2] Demographia World Urban Areas, April 2016 – http://www.demographia.com/db-worldua.pdf

[3] McKinsey Global Institute, October 2013 – http://www.mckinsey.com/mgi/our-research

[4] GSMA, February 2016 – http://www.gsmamobileeconomy.com/2016/global/