The United States has been the world’s largest economy since 1871. We have been invested in the region since the onset and we continue investigate this part of the world for wealth management strategies for our clients.

The US is highly advanced in terms of technology and infrastructure and makes up 25% of the global gross product. There’s a myriad of options available too, with some 2,800 companies being actively traded on the New York Stock Exchange.

Standard & Poor’s 500 Index

The S&P 500, seen as a leading indicator of US equities and a reflection of their performance. The index is a portfolio of the largest 500 companies in the US market ranked by their size. From Apple Inc making up 3.6% of the total, down to the 500th largest company in the market.

The largest companies have changed considerably over time from the early 2000’s. The market was previously dominated by oil companies such as Exxon, PetroChina and Royal Dutch Shell. The top 5 largest companies today are all technology based and this trend looks set to continue.

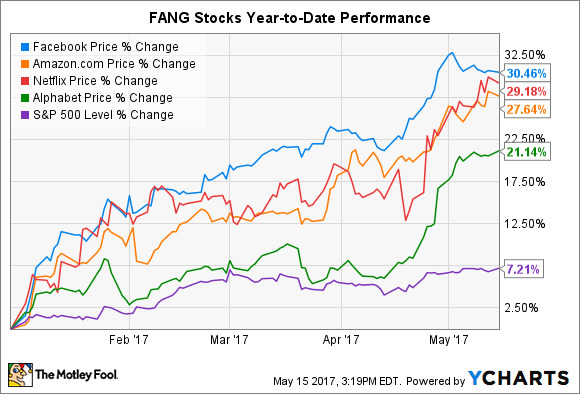

The FANGs are sharp

Leading the technology charge has been the companies affectionately referred to as the FANGS. Facebook, Amazon, Netflix and Google (Alphabet) have seen a meteoric rise over the last three years with the stocks up 150%, 220%, 220% and 80% respectively. Compare this to the S&P 500 increasing by just 27% over the same period. As the chart below shows, the last 6 months have been no exception either:

Source: The Motley Fool (https://www.fool.com/investing/2017/05/15/fang-stocks-are-absolutely-crushing-it-in-2017-tim.aspx)

Further, these company’s revenues have been soaring and activity from users is growing as we continue to integrate our lives with our devices. The companies hold market leading positions in their segments and are driven by some of the world’s best business minds.

On the flip side, the value of the companies has factored in significant growth expectations, making them relatively expensive compared with their competitors. They are at risk if there is a shift in their long-term growth prospects which could spark large swings in their price.

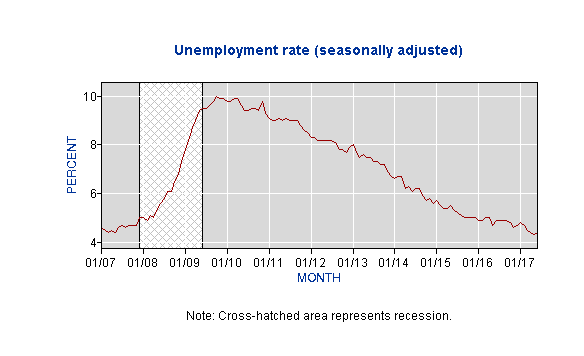

US recovers strongly

The US economy is recovering rather well after being hit hard through the Global Financial Crisis of 2008. The US central bank has begun raising official cash rates and unemployment (below) has significantly reduced since 2010. The share market has responded well to many lead indicators as well as rising company profits for most investments held by our firm. We still see pockets of value in the US market however, like always, careful research and selection are required to avoid value traps and poor long term performance.

Source: US Department of Labour (https://data.bls.gov/pdq/)

How Endorphin Wealth Management can help

Non aligned

The advice we provide at Endorphin is always in our client’s best interests because we are not licensed by the big financial institutions. We’re able to access a range of products from different providers that can be tailored to our client’s needs.

We also utilise subscriptions to three of the top research providers in Australia to cross reference our research and recommendations.

Comprehensive analytics and research

We invest a great deal of time and effort researching the best wealth management strategies for our clients and have developed a number of systems to manage and track the marketplace. We’ve been able to identify some excellent options for our clients to invest in the US market.

The investment landscape always evolves and it is more important than ever to consider your investments and superannuation funds carefully. We pride ourselves on being experts in researching opportunities, investments and strategies that fit in with your retirement goals. We want, our clients to get on with enjoying their life rather than worrying about money.

For an obligation free conversation about your financial future, please contact us on 03 9603 0072 or at advice@endorphinwealth.com.au

Phillip Richards and Robert Rich

Endorphin Wealth Management

Phillip Richards is a qualified Financial Advisor with over ten years’ experience. Contact Phillip today to discuss how you can build your own wealth and plan to reach your retirement goals.

Robert Rich is a qualified Associate Financial Advisor with over nine years of personal investment experience. Contact Robert today to discuss how you can build your own wealth and plan to reach your retirement goals.

This information is general in nature and does not take your personal situation into account.

Contact Us for quality financial advice so you can feel good about your future.