There are over 240 different superannuation funds in Australia and thousands of different investment options available to choose from. We often provide advice on retirement planning to assist our clients compare their current super fund and investments within the market.

We find a proactive approach to superannuation has the potential to significantly increase your balance in retirement. Not only are we able to find fee savings for our clients, but often better performing investments too.

Let’s look closer at how to identify a great super fund and the benefits you can gain from keeping on top of your investments.

Retirement Planning – Superannuation Investments

What should I be invested in?

Some funds will only have a handful of investment options for you to invest in, whilst others will have hundreds of different opportunities available. Tailored financial advice can help you to choose an appropriate mix of investments for your situation.

Direct holdings in quality Australian companies have performed very well over the last 5 years such as Commonwealth Bank (17.9% growth and dividends pa), Telstra (10.9%pa) and Ramsay Health Care (29.8%pa)

Investments like these can potentially assist you to outperform with your investments and maximise your retirement balance.

How are my investments performing?

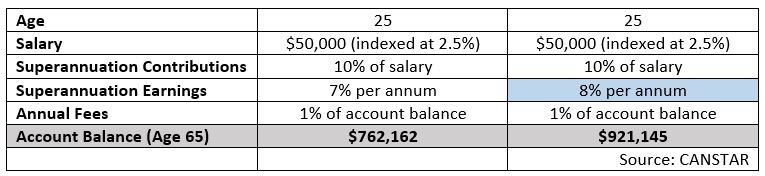

Superannuation is such a long term investment and performance can have a huge impact on how much money you will have built up at retirement. The below table highlights the difference a 1% return per year can make to the end result:

The additional $158,983 could genuinely mean the difference between a carefree retirement or one worrying about your finances.

Retirement Planning – Superannuation Fees

What fees am I paying for my super fund?

There are a number of types of fees commonly charged by superannuation funds to manage your superannuation and the investments held within it. These range in value dramatically and can include Annual Member Fees, Administration Fees, Investment Fees and Performance Fees.

In the same way as performance is important in determining how much money you end up with in retirement, fees can work to erode your savings and a small change in fees can result in a dramatic effect:

How Endorphin Wealth Management can help

Non aligned

Here at Endorphin, we have no alignment to the big banks, so the advice is always in our client’s best interests. We have the advantage of being able to access a range of products from various providers that can be tailored to our client’s needs.

Comprehensive analytics and research

We invest a great deal of time and effort researching the best strategies and investments for our clients. We have, over time, developed a number of systems to manage and track the marketplace. We’ve been able to identify some really well featured and low cost options for our clients to manage their superannuation.

The investment landscape always evolves and it is more important than ever to consider your investments and superannuation funds carefully. We pride ourselves on being experts in researching investments and strategies that fit in with your retirement goals. We want all of our clients to get on with enjoying their life rather than worrying about money.

For an obligation free conversation about your financial future, please contact us on 03 9603 0072 or at advice@endorphinwealth.com.au

Phillip Richards and Robert Rich

Endorphin Wealth Management

Phillip Richards is a qualified Financial Advisor with over ten years’ experience.

Contact Phillip today to discuss how you can build your own wealth and plan to reach your retirement goals.

Robert Rich is a qualified Associate Financial Advisor with over nine years of personal investment experience.

Contact Robert today to plan for your retirement goals.

This information is general in nature and does not take your personal situation into account.

Contact Us today for quality financial advice so you can feel good about your future.