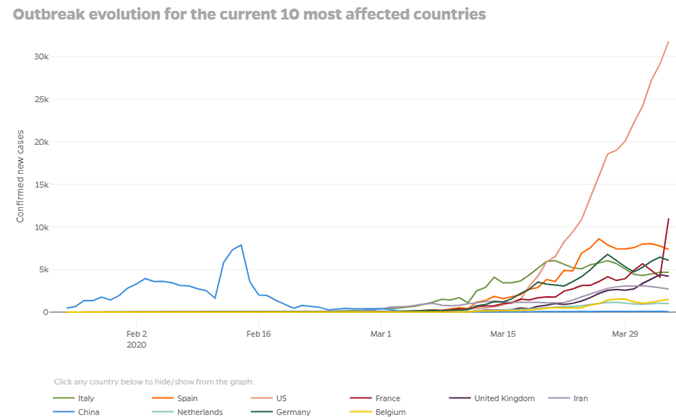

The world economic situation continues to present uncertainty and challenges for investors as the infection and mortality rates of the COVID-19 virus develops at uneven trajectories across countries and regions. The chart below tracking the progress of new cases in the 10 most infected regions shows the epicentre of the virus now seems to have shifted from Europe to the United States, where the real-time impact of COVID-19 has been bought into stark relief last Friday, with labour market data figures showing 10 million people have applied over the past two weeks.

US fiscal support is slowly being rolled out, but it is increasingly clear more support is necessary where Europe, Asia and Australia manufacturing and services industries have effectively been

put on hold.

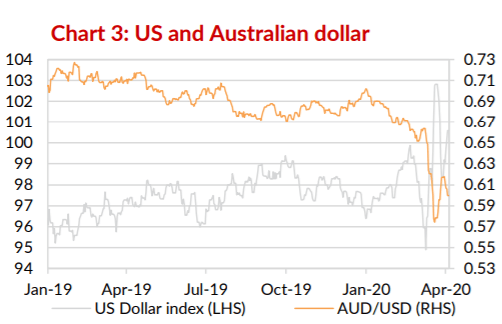

In Australia, wage support and debt relief helped sentiment and supported equity prices. The RBA’s bond buying measures helped keep rates low and the Australian dollar weak, helping cushion the economy somewhat. But the economic fallout is set to be significant and data through April is likely to start showing the impact on our retail, tourism and hospitality sectors

Overall the outlook for global markets is continued volatility, with earnings expectations having been revised lower while governments scramble to contain both the virus and economic fallout.

Below is a range of plausible outcomes for the markets in the coming years – further highlighting the importance of building resilient portfolios that are able to participate in the upside of a V-Shape Recovery, but also protect on the downside of a Depression.

We continue to monitor the ongoing market conditions as part of our wider operations. If you have any questions about your investments or the path that lays ahead, please get in contact with an advisor here at Endorphin Wealth.