There is a perfect storm developing in retirement:

- Thousands of Baby Boomers are retiring every week in Australia, and

- The 100-year life will soon become commonplace.

The Long and Short of it

Longevity is increasing, and a 65-year-old today is living over 10 years longer than their parents and grandparents did. What this means is a longer period to fund in retirement and a requirement for larger retirement benefits.

One fundamental problem with retirement planning is that many professionals are under estimating how long they will live. Whilst most people use life expectancy statistics to determine how long they will live and how much they need in retirement, the issue with these tables is that 50% of people live beyond their life expectancy.

Whilst living an extra 3 to 5 years may seem irrelevant over someone’s lifetime, the finance impact is vast if left unaccounted.

Effects on your Retirement

Living an extra 5 years in retirement could mean you need an extra $200,000 in retirement saving (based on income requirements of $50,000 per year).

When planning for retirement, it is important to consider the financial / lifestyle impact of living beyond your statistical life expectancy. At Endorphin Wealth, we craft our advice to include a strategy for longevity, such as:

- Funding options available to reduce the impact of longevity.

- Discussions around the non-financial impact of longevity.

As a starting point, we always assume the client will live beyond their life expectancy by an extra 5 years. There are a number of strategies we use to address this scenario, depending on the client’s needs/circumstances.

Case Study – Ms Jackson

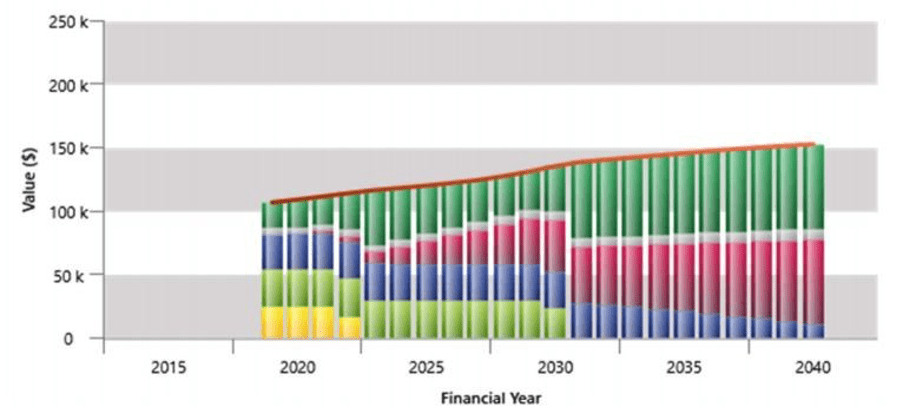

The chart below is a real client example where their life expectancy was 88 (i.e. 2032). We structured her investments, superannuation and income streams to ensure her income requirements of $100,000 per year would be met, well beyond her life expectancy. The different coloured columns represent the different income streams we established as part of the strategy.

It is important to note that no outcome can be guaranteed, ultimately whether you are able to achieve your goals & objectives depends on your personal circumstances, changes to government legislation and investment performance. This highlights the need for ongoing advice.

Ongoing Service

Ongoing advice is critical to the process as an individual’s lifestyle can change quickly when they finish working. Endorphin Wealth recommends that, as part of responsible retirement planning, you regularly review your strategy to ensure it remains in line with your desired retirement lifestyle needs while considering your longevity and life expectancy.

The team at Endorphin Wealth Management is happy to assist with helping you achieve your retirement goals.

For an obligation free discussion, call us on 03 9190 8964, or schedule a meeting at endorphinwealth.com.au/contact/